February 25, 2026

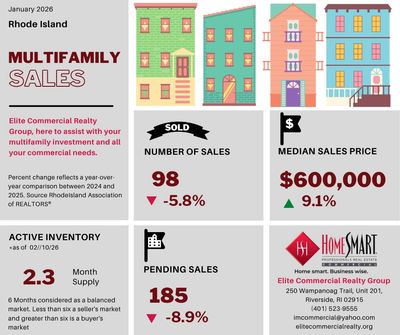

Rhode Island Multifamily Sales January 2026

Multifamily home closings fell 5.8% and the median price of those sales rose 9.1% to $600,000. While still under-supplied, both sectors offered slightly more options for buyers than single-family homes. The multifamily home market is recovering fastest with a 2.3-month supply of listings, though that remains well under the five- to six-month supply that typically indicates a balanced market.

The drop in Rhode Island’s residential home sales dwarfed that seen nationwide, which experienced a 4.4% decline last month, according to the National Association of Realtors. January’s harsh weather patterns likely played a part in the lull in activity.

“If inflation and employment trends remain stable, that should help with some of our affordability problems. It’s critical though, that our elected officials don’t add to the woes of the housing market by tacking on more real estate taxes and regulations during the 2026 session. If we want to get a strong foothold in our housing market’s recovery, it’s critical that we keep costs down for buyers and sellers and remove barriers to development,” said Michael Pereira, President of the Rhode Island Association of Realtors.

#rhodeisland #commecialrealestate #commercialbroker #multifamily #elite #ricommercial #rirealestate

January 27, 2026

Rhode Island Multifamily Sales December 2025

Multifamily Homes See the Largest Price Gains

By the end of the year, the median price of multifamily homes sold in December was up 9.2% from 12 months earlier to $595,000, and up 8.2% overall for the year.

Last year, multifamily home sales stayed relatively stable from 2024, rising just .52%, however sales picked up in December with an annual gain of 7.3% and a slight uptick in pending sales of 1.7%.

“We saw double-digit growth every month in the number of multifamily homes on the market from 2024 to 2025 but it’s still a sellers’ market with low inventory and demand for these types of properties is high. They offer benefits for a wide array of Rhode Islanders, from first-time homeowners and multi-generational families to investors. Ensuring that Rhode Islanders are in a competitive position in this investor-driven market is important,” said Michael Pereira, President of the Rhode Island Association of Realtors.

#rhodeisland #commecialrealestate #commercialbroker #multifamily #elite #ricommercial #rirealestate

December 19, 2025

Rhode Island Multifamily Sales November 2025

In other areas of the market, multifamily home sales increased by 6.6% and condominium sales rose by 11.1% from a year ago. Both sectors also showed an annual uptick in median price. At $580,000, the multifamily home median rose 2.9% from November 2024 and the condominium market’s median price of $405,000 represented a 3.9% increase.

Like the single-family home market, supply remains well below balanced levels. The multifamily home market offered the most options for buyers with a 2.7-month supply. The supply of condominiums mirrored that of single-family homes at 2.3 months.

“This year, we’ve slowly seen improvement in seeing more choices for buyers overall. We’re hopeful that increased supply and better mortgage rates will help continue that trend in 2026. We’re also excited to see some of the State’s initiatives to increase housing supply begin to take hold, but we can’t take our foot off the gas pedal. There’s a lot of work to be done to ensure that Rhode Islanders have an affordable place to call home,” said Pereira.

#rhodeisland #commecialrealestate #commercialbroker #multifamily #elite #ricommercial #rirealestate

November 21, 2025

Rhode Island Multifamily Sales October 2025

“We were in a holding pattern in October. The government shutdown delayed some closings so we could see sales rebound towards the end of the year. But, with economic uncertainty brewing, prospective buyers are more tentative than ever. The situation is particularly hard for first-time buyers, who now make up only 24% of the buying market,” said Michael Pereira, President of the Rhode Island Association of Realtors.

Condominium sales fell 20.0% from October 2024. Those under contract but not closed by month’s end were up 3.3%. An attractive option for first-time buyers and empty nesters due to their lower price point, the median sales price rose 10.6% last month to $392,500.

The multifamily home sector also saw diminishing sales, with a 17.5% drop in closing activity compared to the prior year. Pending sales fell 6.2%. The lull in activity did not impede rising prices however, which rose 7.1% to hit a new high of $600,000.

#rhodeisland #commecialrealestate #commercialbroker #multifamily #elite #ricommercial #rirealestate

NOVEMBER 14, 2025

🔥 BIG ANNOUNCEMENT!🔥

We’re excited to welcome Will Tangui to the HomeSmart Professionals Real Estate + Elite Commercial Realty Group team!

Will’s energy, drive, and commitment to top-tier client service make him a perfect addition to our powerhouse lineup. Let’s go, Will!

#WelcomeToTheTeam #RealEstatePro #EliteCommercialRealty #HomeSmartProfessionals

#rhodeisland #commecialrealestate #commercialbroker #multifamily #elite #ricommercial #rirealestate

OCTOBER 23, 2025

Rhode Island Multifamily Sales September 2025

After falling year over year in July and August, sales activity of single-family homes jumped in September, rising 19.5% from September 2024. At the same time, the median sales price climbed 9.3% to $530,000.

Other segments of the market also experienced a rise in closed transactions last month. Condominium sales were up 23.6% and multifamily home sales rose 20.8%. Unlike the single-family home market, both sectors saw a slight decrease in median price. The median price of condominiums fell 2.3% to $417,450, and the multifamily home median saw a drop of .8%, falling from $595,000 in September 2024 to $590,000 last month.

The Rhode Island Association of Realtors, which releases the sales data of all Realtor-assisted sales each month, cited multiple factors in the hike in sales activity. A strong stock market, increased home equity and lower mortgage rates continued to help encourage sales, but an increase in the sales conveyance tax which was enacted on October 1st, was likely the primary factor according to the association. The Realtor Association shared that data shows a 31% drop in sales in the two weeks following the October 1 deadline compared to the same time last year.

“Looking ahead, we’re hopeful that reduced rates will help our affordability issues. But more buyers in the market with little change to our housing stock will only mean higher home values. We can’t overlook the elephant in the room, that’s why we will continue to work together with our policymakers on reforms that encourage the creation of new, sensible housing,” said Whitten.

#rhodeisland #commecialrealestate #commercialbroker #multifamily #elite #ricommercial #rirealestate

September 24, 2025

Rhode Island Multifamily Sales August 2025

Sales activity showed no change from year to year in the multifamily home market though pending sales dropped 12.7%. Although there were 38.1% more multifamily homes on the market last month than in August 2024, inventory remains inadequate to meet demand, resulting in monthly median prices that have not dropped year over year since December 2014. The August median price of multifamily homes was $580,000, 5.7% higher than 12 months prior.

“Looking ahead, we’re hopeful that reduced rates will help our affordability issues. But more buyers in the market with little change to our housing stock will only mean higher home values. We can’t overlook the elephant in the room, that’s why we will continue to work together with our policymakers on reforms that encourage the creation of new, sensible housing,” said Whitten.

#rhodeisland #commecialrealestate #commercialbroker #multifamily #elite #ricommercial #rirealestate

AUGUST 23, 2025

Rhode Island Multifamily Sales July 2025

While sales of multifamily homes also dropped, falling 11.3% from 12 months earlier, the median price of July sales rose to $618,000, a 12.4% annual gain and the first time the median price of any residential property type in Rhode Island topped $600,000.

Both sectors had an increase in listings in July. The Realtor data showed a 29.3% increase in condominiums listed on the market for sale, resulting in a 2.9-month supply. Multifamily home inventory made even stronger gains, growing by 44.2% year-over-year. However, strong sales activity left only a 1.7-month supply on the market, the cause of the sector’s elevated price gains.

“Investor demand is driving up the prices of multifamily properties. What was once a great investment for first-time buyers is now a hot commodity in a competitive market. As a result, some buyers may end up living in a desired property, but unfortunately, as a tenant, rather than an owner. It’s critically important that we continue to have the conversations and make the adjustments necessary to create enough housing to temper the demand that is currently shutting too many Rhode Islanders out of the market,” said Whitten.

#rhodeisland #commecialrealestate #commercialbroker #multifamily #elite #ricommercial #rirealestate

July 23, 2025

Rhode Island Multifamily Sales June 2025

62% Increase in Multifamily Home Listings

The multifamily home market saw the highest increase in the number of properties for sale, with 62% more multifamily homes listed for sale last month compared to 12 months earlier. A significant jump in listings began in the second quarter with a 50.3% hike in April, followed by a 60.1% jump in May.

Despite the biggest increase in available inventory, the sector saw the smallest increase in sales. June saw a 4.1% increase in sales over last year, while the median price grew 13% to $599,000. The sales cycle was shorter among multifamily home sales throughout the second quarter than other property types, with properties staying on the market just 27 days.

“Multifamily home sales were down in April and May but rebounded in June, accompanied with a significant increase in median price. At the same time, we’ve seen a big spike in multifamily listings over the past few months. The costs associated with increased regulations, laws and taxes on local landlords seem to be prompting some long-time property owners to sell to avoid all the recent headaches, particularly when they’re seeing a 115% increase in median price in the past six years, the highest gain of all types of residential homes. In the past, duplexes and 3-families were a great way for first-time buyers and multi-generational families to gain generational wealth, but with increased regulation and the median multi-family price nearing $600k, it’s near impossible for them to break into this market,” commented Whitten.

All residential property types saw an increase in the number of properties available for sale, though Rhode Island’s residential home market continues to offer just half the supply that is considered a healthy market at the current rate of sales.

#rhodeisland #commecialrealestate #commercialbroker #multifamily #elite #ricommercial #rirealestate

JUNE 26, 2025

Rhode Island Multifamily Sales May 2025

Rhode Island’s May single-family home median price of $512,750 eclipsed the $460,000 price of May 2024 and was $47,750 more than that seen at the beginning of this year. The median sales price of multifamily homes also reached a new high at $590,000, marking the first time that the price in both sectors topped $500,000. At $390,000, condominium sales saw an 11.5% year-over-year gain.

Compared to 12 months earlier, sales increased by nine percent in the single-family housing market due to a 20% increase in homes listed for sale. Even with that increase in inventory however, Rhode Island’s 2.3-month supply of homes on the market remains less than half of the five to six-month supply that is typically considered a healthy market.

In the condominium market, sales rose 2.4% from 12 months earlier and multifamily home sales fell nine percent. The supply of both sectors fared slightly better than that of the single-family home market. At the current rate of sales, if no new condominiums are put on the market, the supply would be deleted in 2.6 months and multifamily home inventory would be sold

#rhodeisland #commecialrealestate #commercialbroker #multifamily #elite #ricommercial #rirealestate

MAY 28, 2025

Rhode Island Multifamily Sales April 2025

Sales under contract but not closed before the end of April were up from last year in both the single-family and multifamily home sectors, which is typically an indication of increased closed transactions in the months ahead.

Closed single-family home sales stayed relatively stable, falling less than 1% year-over-year. The median sales price rose 6% to $480,000.

Sales dropped more significantly in the condominium and multifamily home markets, falling by 11.8% and 18.3%, respectively. The median price of condominiums rose 3.5% to $362,000, while the median sales price of multifamily homes rose 6.7% to $560,000.

#rhodeisland #commecialrealestate #commercialbroker #multifamily #elite #ricommercial #rirealestate

April 23, 2025

Rhode Island Multifamily Sales March 2025

Sales activity saw the opposite trend in the multifamily home market with a 14.3% increase in closed sales last month. Pending sales also rose slightly following five months of no gains.

The median price of multi-family homes sold rose 8.8% to $582,278 as high demand continued to fuel prices.

“Given the volatility of the stock market, multifamily homes are an extremely attractive investment here in the Ocean State. They’re great for investors, multigenerational families and first-time homeowners. We’ll be watching closely to see how both tariffs and increasing demand for supplies affect development. We need to continue to promote sensible new construction and rehab projects here in Rhode Island amidst our housing crisis. We’ll continue to work together with our city and town officials, our state legislators and beloved communities to provide the housing our state is in dire need of,” said Whitten.

#rhodeisland #commecialrealestate #commercialbroker #multifamily #elite #ricommercial #rirealestate

MARCH 25, 2025

CREXI Platinum Award Winner 2025

Excited to share that I’ve been honored as a 2025 @CREXinc Platinum Award winner! This incredible platform has truly elevated my business, and I’m grateful for the opportunity to collaborate with their amazing team. Thank you!

February 5, 2025

Exciting Announcement: Michael Alves Joins HomeSmart Professionals Commercial Division!

Mike is the Broker/Owner of Elite Commercial Realty, a name synonymous with excellence, integrity, and results in the commercial real estate industry. With an impressive career spanning four decades of service, Mike has built a reputation as a trusted advisor, dedicated mentor, and tireless advocate for his clients.

His passion for commercial real estate, combined with his unwavering commitment to professionalism and client success, has set him apart as a true industry leader.

His remarkable achievements speak for themselves. By the end of 2024, Elite Commercial Realty was recognized as the #1 Top Group at KW Leading Edge, a testament to his team’s dedication, expertise, and dominance in the commercial real estate sector. In 2022, Mike earned 1st Place in the Commercial Sales Awards with the same firm, further solidifying his position as one of the most accomplished commercial brokers in the region.

Now, as he joins HomeSmart Professionals Real Estate, Mike is eager to bring his wealth of knowledge, experience, and industry insight to the team. His vision is to contribute to the firm’s continued growth and innovation, helping to expand its presence in the commercial sector while fostering a culture of excellence. With his proven ability to identify market opportunities, negotiate complex deals, and mentor upcoming professionals, Mike is poised to make a lasting impact at HomeSmart.

Throughout his career, Mike has held key leadership positionsthat have shaped the commercial real estate landscape. As the New England Commercial Director of KW Commercial Division, he played a pivotal role in growing and enhancing the commercial sector. His expertise and deep market knowledge have not only driven successful transactions but have also inspired and educated countless professionals. His ability to lead, innovate, and execute strategic initiatives has helped businesses, investors, and developers achieve long-term success.

Mike’s commitment to the industry goes beyond sales—he is also a former President of the R.I. Commercial and Appraisal Board of Realtors (RICABOR), where he dedicated himself to advancing the commercial real estate profession. His influence extends to education and professional development, having served as an Instructor and Director at RIAR and RPAC, as well as a Top Dogs Institute Instructor. His impact was further solidified as the Creator and Regional Director of Coldwell Banker’s Commercial Real Estate Division in R.I. from 2002 to 2008, where he helped shape the growth and success of the division. Mike's extensive experience, paired with his deep-rooted passion for helping others succeed, has cemented his legacyas a highly respected leader in commercial real estate. He has built strong relationships with clients, colleagues, and industry professionals, and his influence has left a lasting markthrough his dedication to mentorship, professional development, and client success.

As he embarks on this exciting new chapter with HomeSmart Professionals Real Estate, Mike is excited about the opportunities ahead. His goal is to leverage his extensive expertise to enhance the firm’s commercial real estate offerings, provide valuable guidance to fellow agents, and continue delivering exceptional service to his clients. His hard work, professionalism, and relentless drive remain the foundation of his success, and he looks forward to achieving new milestones with the HomeSmart team.

Please join us in welcoming Mike Alves to the HomeSmart family—a partnership that promises innovation, growth, and continued excellence in commercial real estate!

January 9, 2025

#1 Top Group for December 2024 at KW Leading Edge! 🎉

We are thrilled to announce that KW Commercial - Elite Commercial Realty has been recognized as the #1 Top Group for December 2024 at KW Leading Edge! 🎉

This achievement reflects our unwavering commitment to excellence, teamwork, and delivering exceptional results for our clients and partners. We are truly grateful for your trust and support, which has played a vital role in our success.

As we move into 2025, we are excited to continue providing top-notch service and expertise in the commercial real estate industry.

Thank you for being a part of our journey. Here's to even greater accomplishments together in the year ahead!

MARCH 24, 2025

Rhode Island Multifamily Sales February 2025

Sales in the multifamily home market rose by 7.9% compared to February 2024, though pending sales also fell by 6.8%. Multifamily homes continue to be among the priciest on the market, with the midpoint of all sales landing at $559,950, a 7.7% increase from the prior year.

“The upside to owning a multifamily has always been the great potential to obtain passive rental income and the ability to gain generational wealth. More importantly, in today’s housing crisis, multifamilies are also a very desirable option for multigenerational families or an owner-occupied buyer looking to reduce monthly costs through rental income. However, with a very limited supply of existing stock, climbing sale prices and costly regulatory mandates for landlords of rentals units here in Rhode Island, the benefits of owing a multifamily home are quickly eroding.” said Chris Whitten, president of the Rhode Island Association of Realtors.

#rhodeisland #commecialrealestate #commercialbroker #multifamily #elite #ricommercial #rirealestate

FEBRUARY 25, 2025

Rhode Island Multifamily Sales January 2025

Multifamily home sales stayed relatively stable last month, with sales falling just 1% from the previous January. The median sales price rose 15.8% to $550,000 and the number of listings increased 16.7% year over year, leaving a 1.7-month supply of multifamily homes on the market.

“Housing development in Rhode Island has remained stagnant for far too long. Most states have regained some balance between supply and demand, but we’ve made little to no headway here in Rhode Island due to new construction hurdles and loads of red tape. But I truly believe by working together at the local and state levels we can right this ship,” said Rhode Island Association of Realtors 2025 President Chris Whitten.

#rhodeisland #commecialrealestate #commercialbroker #multifamily #elite #ricommercial #rirealestate

JANUARY 27, 2025

Rhode Island Multifamily Sales December 2024

Sales held relatively steady in the multifamily home market, rising just 1.5% from the prior year and number of pending sales under contract saw no change from 12 months earlier. The median price of $545,000 however, represented a 13.5% hike.

“Many keep asking why we’re not feeling a slight market cooling like most of the rest of the country. The two biggest factors include our severe drought of new construction units paired with those from out-of-state, particularly Massachusetts, looking at Rhode Island as a more affordable option. Many housing market experts have their eyes on RI as one of the nation’s hottest housing markets here in 2025,” Whitten said.

#rhodeisland #commecialrealestate #commercialbroker #multifamily #elite #ricommercial #rirealestate

DECEMBER 20, 2024

Rhode Island Multifamily Sales November 2024

A slowdown in sales activity is also evident in the multifamily home market. Last month, sales decreased by 13.8%, and pending sales dropped by 2.5% from November 2023. The median price of those sales rose to $563,500 compared to $492,000 last year.

“As we move into the New Year, we expect to see more activity in the housing market. Since the beginning of 2022, the 'lock-in effect’ has most homeowners hanging onto their low interest rates causing stalled sales and lessened inventory. Therefore, life changes that typically precipitate a move like divorce, babies and job relocation have been put on hold. But we anticipate with the equity gains homeowners have made along with many getting used to the 'new normal' in mortgage rates, that inventory will continue to grow as the new year progresses.” said Whitten.

#rhodeisland #commecialrealestate #commercialbroker #multifamily #elite #ricommercial #rirealestate

November 26, 2024

Rhode Island Multifamily Sales October 2024

Sales of multifamily homes also made significant gains. The median price of sales rose from $482,500 in October 2023 to $560,000 last month and closed sales increased by 17.2%. According to the National Association of Realtors’ 2024 Profile of Home Buyers and Sellers, 17% of home buyers purchased a multigenerational home from June 2023 to June 2024, the highest share ever recorded. Cost savings and the inability of young adults to access affordable housing on their own fueled the demand. The same report cited that first-time buyers are 38 years old, the oldest on record and have an income of $97,000, $26,000 more than just two years ago.

“We’re seeing homeowners who are tapping into their equity and 401K and competing for properties with first-time home buyers without those luxuries. Many are cash buyers who are downsizing or buying a second home. It’s tough for younger buyers to compete with that. Down payment assistance programs help slightly but lack of inventory, higher prices and interest rates are still the biggest pain points preventing our younger generations from starting to build equity through home ownership,” said Whitten.

#rhodeisland #commecialrealestate #commercialbroker #multifamily #elite #ricommercial #rirealestate

Copyright © 2018 Elite Commercial Realty - All Rights Reserved.